Automation and Digitalisation Report 2024

Exclusive research for MMi Automation and Digitalisation Report 2024 shows mining companies are embracing cutting-edge tech

MMi Automation and Digitalisation Report 2024 looks at how hardware and software combine to drive efficiencies in mining

The 2024 MMI Automation and Digitalisation Report highlights how mining companies are increasingly adopting cutting-edge technologies to meet global sustainability goals and enhance operational efficiency.

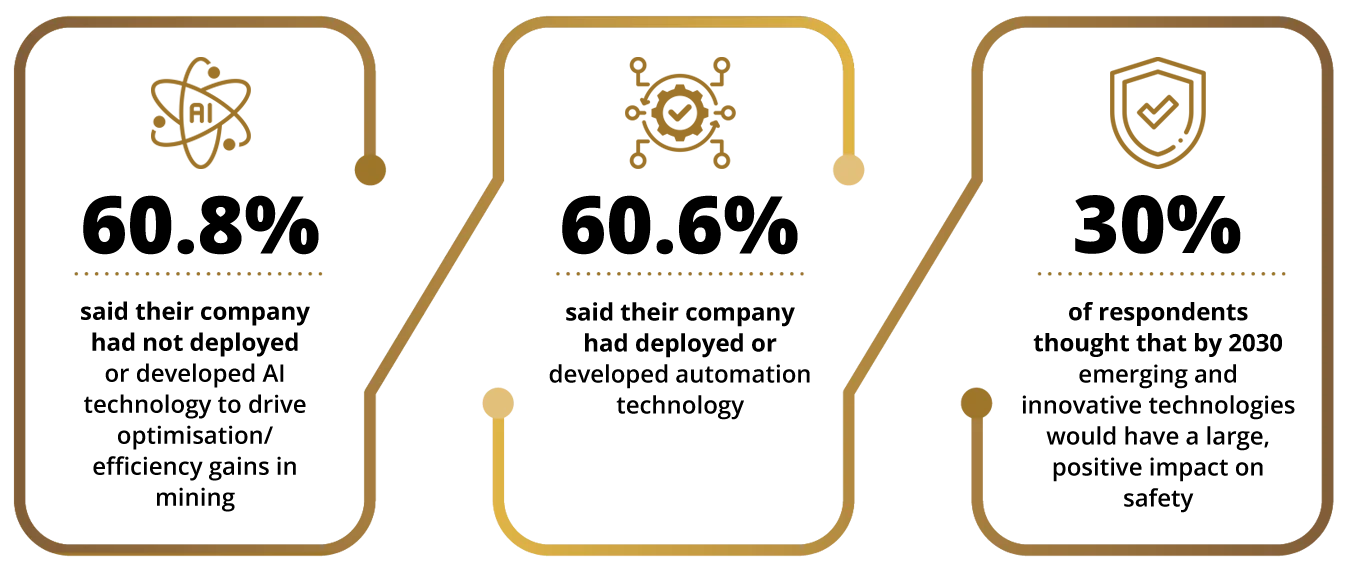

The report finds transformative trends, with over 60% of surveyed mining professionals confirming the deployment of automation technologies. From autonomous vehicles to remote operating centres, innovations are enhancing safety, reducing workforce exposure to hazardous environments, and streamlining operations. For instance, Rio Tinto’s Perth operations centre controls 50 autonomous trucks remotely, improving efficiency and safety.

However, artificial intelligence (AI) adoption lags behind, with only 39% of respondents implementing AI solutions. Despite challenges, AI shows promise in areas such as predictive maintenance and ore sorting, with potential to increase mineral yield and cut transportation costs.

The industry faces barriers to adoption, including high upfront costs, skill shortages, and cultural resistance to change.

Methodology:

We received 223 responses to our survey, with 42.2% of these coming from mining equipment, technology or services (METS) companies. Mining companies (producing) made up 17.5% of respondents, while mineral exploration companies that are not currently producing were 8.1% of the whole. Investment companies accounted for 4.5% of responses. Those 27.8% of respondents classified as ‘other’ included consultants and a small proportion of academics, contractors, chemical suppliers and other professionals close to the mining industry. Of all respondents, 44% were in senior or middle management, with 22.9% at the board level or on the executive committee of the company they work for, meaning that a significant number can be described as decision makers. More than one in 10 (12.1%) of respondents were from companies with market capitalisation of more than US$5 billion, with 10.8% in the $1 billion to $5 billion category, and 29.6% from companies with market caps of less than $250 million.

Mining Magazine Premium Subscribers can read the full report online.

If you'd like to subscribe or upgrade to a Premium Subscription, click here or contact the team at subscriptions@aspermont.com or on +44 (0) 208 187 2299.

Copyright © 2000-2024 Aspermont Media Ltd. All rights reserved. Aspermont Media is a company registered in England and Wales. Company No. 08096447. VAT No. 136738101. Aspermont Media, WeWork, 1 Poultry, London, EC2R 8EJ.